While testing a new platform on April 22nd, Bank of America exposed client’s Paycheck Protection Program applications to external lenders and their vendors. This was done while uploading the data to the new platform. Bank of America did not state the amount of impacted clients, but they have stated they have processed over 300,000 applications. Bank of America is in the process of contacting those impacted by this incident. It has been reported that Tax Identification Numbers, Social Security Numbers, full names, phone numbers, and citizenship status could be part of the exposed data.

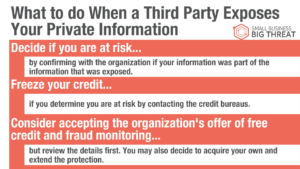

When a third party exposes your private information, what can you do? For starters, confirm with the organization if your information was part of what was exposed and find out the type of data exposed, this way you can decide if you are at risk. If you decide you are at risk, consider contacting the credit bureaus to freeze your credit. Typically the organization who exposed your data will offer free credit and fraud monitoring, consider accepting the offer, but review the details first. You can also decide to acquire your own protection and extend it for a longer period of time.

To learn more about this incident and other ways to protect yourself online, checkout this article on password protection at Small Business, Big Threat.

Stay up-to-date with all the latest cybersecurity news by subscribing to our monthly newsletters!